Download the tender document or call us directly for more information.

At ICMAI, SERAMPORE- HOOGHLY CHAPTER, we try to encourage our students to put their heart, mind and soul into even at smallest acts. We organize regular Career Counseling Sessions for our students and provide career support through campus interviews by reputed institutions. ICMAI, Serampore- Hooghly Chapter is happy to see that the CMA students from Hooghly district are finding their position in various organizations and taking forward the vision for introducing responsible business across the nooks and corners of our economy.

The CMA Professionals would ethically driven enterprises globally by creating value to stakeholders in the socio-economic context through competencies drawn from the integration of strategy, management and accounting.

The Institute of Cost Accountants of India would be the preferred source of resources and professionals for the financial leadership of enterprises globally.

CPE PROGRAMME ON : I) The impact of AI on Accounting & Finance. II) Social Stock Exchange & Social Impact Assessment GUEST SPEAKERS: I) CMA Subhasish Chakraborty (Chairman -EIRC of ICMAI) II) CS Arpan Sengupta (Practicing Company Secretary) DATE: 24th NOVEMBER,2024 (SUNDAY) TIME: 2.30 ..

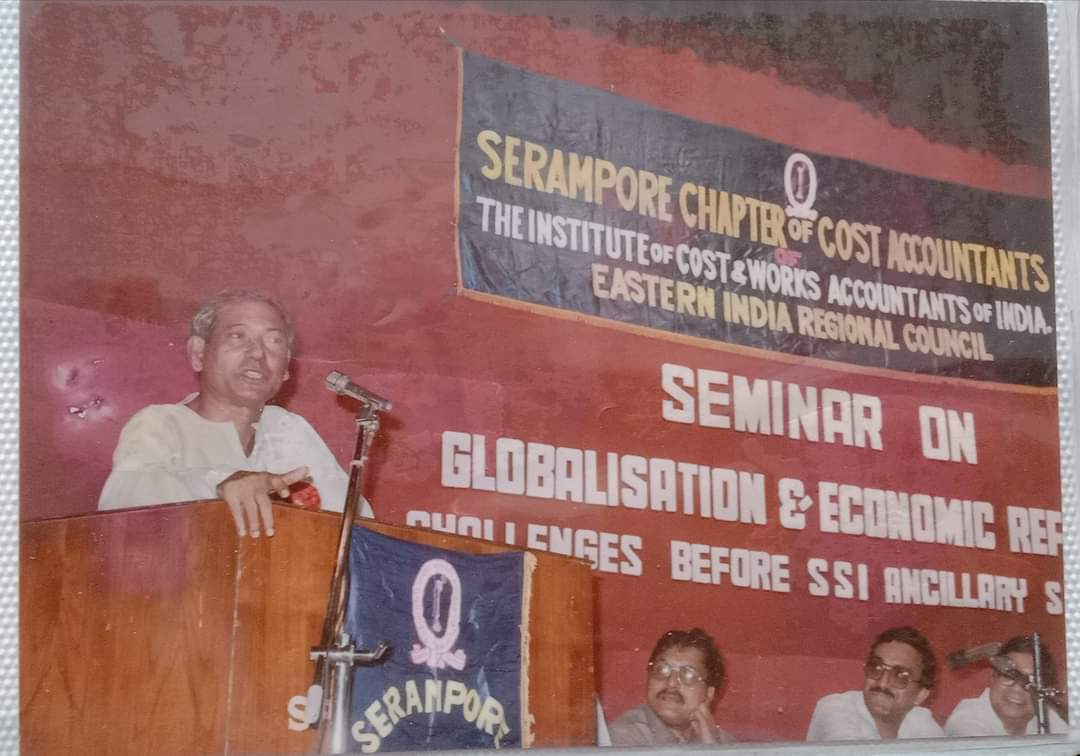

Opening ceremony 61st coaching class..

ROC (Registrar of Companies) filing and forensic audit are two separate but related concepts in the corporate world. 1. ROC Filing: ROC filing refers to the mandatory filing of various documents and forms with the Registrar of Companies by companies registered under the Companies Act. These fili..

Our industry-oriented training program is designed to provide participants with the practical skills, knowledge, and hands-on experience needed to excel in today's competitive job market...

Tax planning and management is one of the primary areas accountants help their clients. Taxes are either direct tax or indirect tax. Where the amount of direct tax owing can be influenced by other factors, indirect taxes are straightforward in that their calculation is typically a predetermined perc..

The Tax Excessive CEO Pay Act, introduced by lawmakers aims to address income inequality by imposing a corporate tax rate increase on companies with a high CEO-to-worker pay ratio. Under this act, if a corporation’s CEO or highest-paid employee’s compensation exceeds 50 times the median worke..

The Tax Deducted at Source (“TDS”) provisions under the Indian Income Tax Act of 1961 (“IT Act”) have been the cornerstone of the country’s tax architecture. A payer (or a deductor) is expected to be vigilant at the time of entering into any transaction, so that the required taxes are duly..

Srishti Apartment,Ground Floor,89,G.T.Road (West),Belting Bazar,Serampore,Hooghly-712203

(033) 3570-7225

serampore@icmai.in